Marginal Tax Rates 2024 Bc

Marginal Tax Rates 2024 Bc. Learn about marginal tax rates and how they differ from the average tax. Income past a certain point is taxed at a higher rate.

These are the federal and provincial income tax brackets and tax rates in canada for 2023 and 2024. Personal income tax rates apply to specific tax brackets.

These Rates Apply To Your Taxable Income.

For example, if your taxable income is $50,000, you would pay 5.06% tax on the first $22,277, 7.70% tax on the following $23,377, and 10.50% tax on the last $4,350.

For Example, If Your Taxable Income After Deductions And Exemptions Was $42,000, Your Federal Tax Owing Is 15%, And Your Bc Provincial Amount Owing Is 5.06%, Your Marginal Tax Rate (15% + 5.06%) Is 20.06%.

Personal income tax rates apply to specific tax brackets.

Marginal Tax Rates 2024 Bc Images References :

Source: tupuy.com

Source: tupuy.com

Australia Marginal Tax Rates 2024 Printable Online, For example, if your taxable income is $50,000, you would pay 5.06% tax on the first $22,277, 7.70% tax on the following $23,377, and 10.50% tax on the last $4,350. The inflation rate to be used to index the 2024 tax brackets and amounts would be 4.7%.

Source: www.kitces.com

Source: www.kitces.com

Marginal Tax Rates Chart For 2024, Due to rising inflation, many taxpayers and financial experts expect an increase. There are also various tax credits, deductions and benefits available to you to reduce your total tax payable.

Source: lisbethwelise.pages.dev

Source: lisbethwelise.pages.dev

Marginal Tax Brackets For Tax Year 2024 Eve Harriott, The current limit of rs. Income tax expectations budget 2024:

Source: loneezitella.pages.dev

Source: loneezitella.pages.dev

2024 Tax Rates And Brackets Canada Revenue Agency Katee Ethelda, The corporate and personal tax rates also remain unchanged for 2024. For example, if your taxable income is $50,000, you would pay 5.06% tax on the first $22,277, 7.70% tax on the following $23,377, and 10.50% tax on the last $4,350.

Source: jennicawadorne.pages.dev

Source: jennicawadorne.pages.dev

2024 Tax Brackets Canada Mandi Rozella, For example, if your taxable income is $50,000, you would pay 5.06% tax on the first $22,277, 7.70% tax on the following $23,377, and 10.50% tax on the last $4,350. Marginal tax rate for capital gains is a % of total capital gains (not taxable capital gains).

Source: printableformsfree.com

Source: printableformsfree.com

Tax Rates 2023 Vs 2024 Printable Forms Free Online, 1.5 lakh has remained unchanged since 2014. British columbia's marginal tax rate increases as your income increases so you pay higher taxes on the level of income that falls into a higher tax bracket.

Source: imagetou.com

Source: imagetou.com

Tax Calculator Canada 2024 Image to u, The tax rates in british columbia range from 5.06% to 20.5% of income and the combined federal and provincial tax rate is between 20.06% and 53.5%. These are the federal and provincial income tax brackets and tax rates in canada for 2023 and 2024.

Marginal tax rates and average tax rates for the generalized, How much tax will i pay on my income in british columbia? Bc budget 2024 introduces new tax measures designed to help improve housing supply, amend the employer health tax, and address affordability, among others.

Source: camilleoauria.pages.dev

Source: camilleoauria.pages.dev

Ca State Tax Brackets 2024 Bobbi Chrissy, Income tax expectations budget 2024: Your taxable income is your income after various deductions, credits, and exemptions have been applied.

Source: upstatetaxp.com

Source: upstatetaxp.com

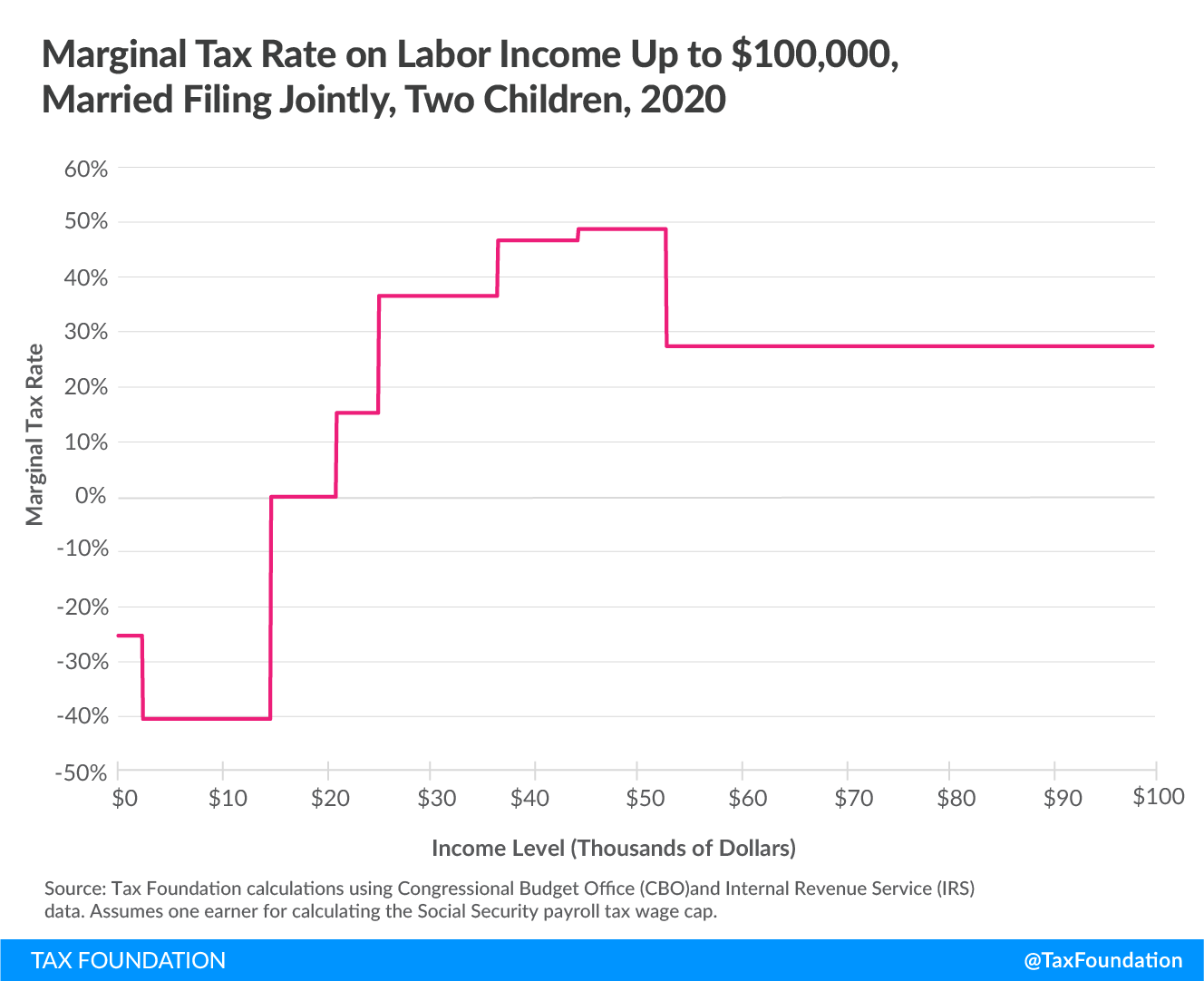

Marginal Tax Rates on Labor in the U.S. After the Tax Cuts and, The corporate and personal tax rates also remain unchanged for 2024. The calculation of the effective tax rate and marginal tax rate for a $ 120,000.00 annual salary in british columbia for the 2024 tax year is based on annual taxable income.

Due To Rising Inflation, Many Taxpayers And Financial Experts Expect An Increase.

The tax tables below include the tax rates, thresholds and allowances included in the british columbia tax calculator 2024.

2024 Federal Income Tax Rates.

While indian taxpayers earning more than rs 5 crore pay 39% tax under the new regime, which includes a 25% surcharge on income above this threshold, the top earners in canada pay an average of 50.